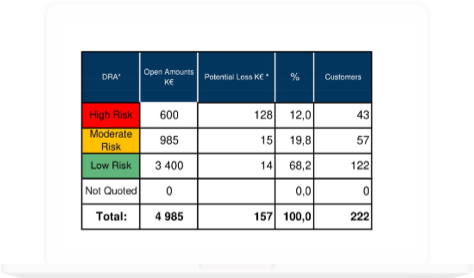

CofaScan: check your customers’ risk score

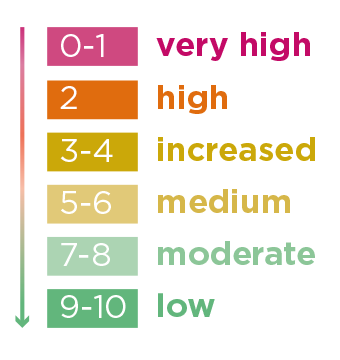

CofaScan is an analytical solution that merges your customer data with our global database, Coface Predictive Information. You will receive a consolidated overview of your customers’ scores following a Debtor Risk Assessment (DRA) and information on potential losses within your portfolio.

The report CofaScan will deliver, will help you to make smart business decisions: